Debt Consultant with EDUdebt Singapore: Personalized Debt Relief Program

Debt Consultant with EDUdebt Singapore: Personalized Debt Relief Program

Blog Article

Open the Conveniences of Engaging Debt Expert Provider to Navigate Your Course In The Direction Of Debt Relief and Financial Liberty

Engaging the solutions of a debt professional can be a crucial step in your journey in the direction of achieving financial obligation relief and monetary stability. These professionals use tailored methods that not just examine your one-of-a-kind monetary situations but likewise provide the essential guidance required to navigate complicated arrangements with lenders. Recognizing the complex benefits of such expertise might disclose options you had not previously thought about. Yet, the question remains: what certain advantages can a financial debt consultant give your monetary circumstance, and exactly how can you determine the appropriate companion in this venture?

Comprehending Financial Obligation Consultant Services

Debt expert solutions supply specialized advice for individuals grappling with financial challenges. By assessing your revenue, financial obligations, and expenditures, a financial obligation specialist can aid you recognize the origin creates of your economic distress, enabling for a more exact technique to resolution.

Financial obligation experts usually utilize a multi-faceted approach, which may consist of budgeting assistance, settlement with creditors, and the growth of a tactical settlement plan. They function as middlemans in between you and your financial institutions, leveraging their proficiency to bargain extra positive terms, such as lowered rate of interest rates or extensive payment timelines.

Additionally, financial obligation experts are outfitted with up-to-date expertise of pertinent laws and regulations, making certain that you are informed of your legal rights and options. This professional assistance not just alleviates the emotional concern related to debt however likewise empowers you with the tools required to gain back control of your economic future. Ultimately, engaging with debt consultant services can lead to a more structured and enlightened course towards economic stability.

Key Advantages of Specialist Support

Engaging with financial obligation specialist services provides many benefits that can significantly boost your financial circumstance. Among the primary advantages is the competence that experts bring to the table. Their comprehensive expertise of financial debt monitoring approaches allows them to tailor solutions that fit your one-of-a-kind conditions, making certain a more efficient strategy to accomplishing financial stability.

In addition, debt consultants commonly provide negotiation support with lenders. Their experience can result in much more beneficial terms, such as lowered rate of interest or settled debts, which might not be attainable through straight negotiation. This can result in considerable financial alleviation.

Additionally, professionals provide an organized plan for repayment, aiding you focus on financial obligations and designate sources effectively. This not just simplifies the repayment process yet additionally cultivates a feeling of liability and development.

Inevitably, the mix of specialist guidance, settlement skills, structured repayment strategies, and emotional support settings financial debt consultants as valuable allies in the search of financial debt relief and economic liberty.

How to Select the Right Specialist

When selecting the right financial debt expert, what essential variables should you think about to guarantee a positive outcome? Initially, analyze the consultant's credentials and experience. debt consultant services singapore. Seek accreditations from recognized companies, as these show a level of professionalism and reliability and knowledge in financial obligation monitoring

Next, consider the consultant's credibility. Research on-line reviews, reviews, and scores to gauge previous customers' contentment. A solid track document of successful debt resolution is crucial.

Furthermore, review the consultant's strategy to financial obligation management. A good specialist ought to supply tailored solutions customized to your distinct economic situation instead than a one-size-fits-all option - debt consultant services singapore. Transparency in their processes and charges is critical; ensure you recognize the prices involved before devoting

Interaction is another vital factor. Choose a consultant who is prepared and approachable to answer your concerns, as a solid working partnership can improve your experience.

Typical Financial Obligation Relief Techniques

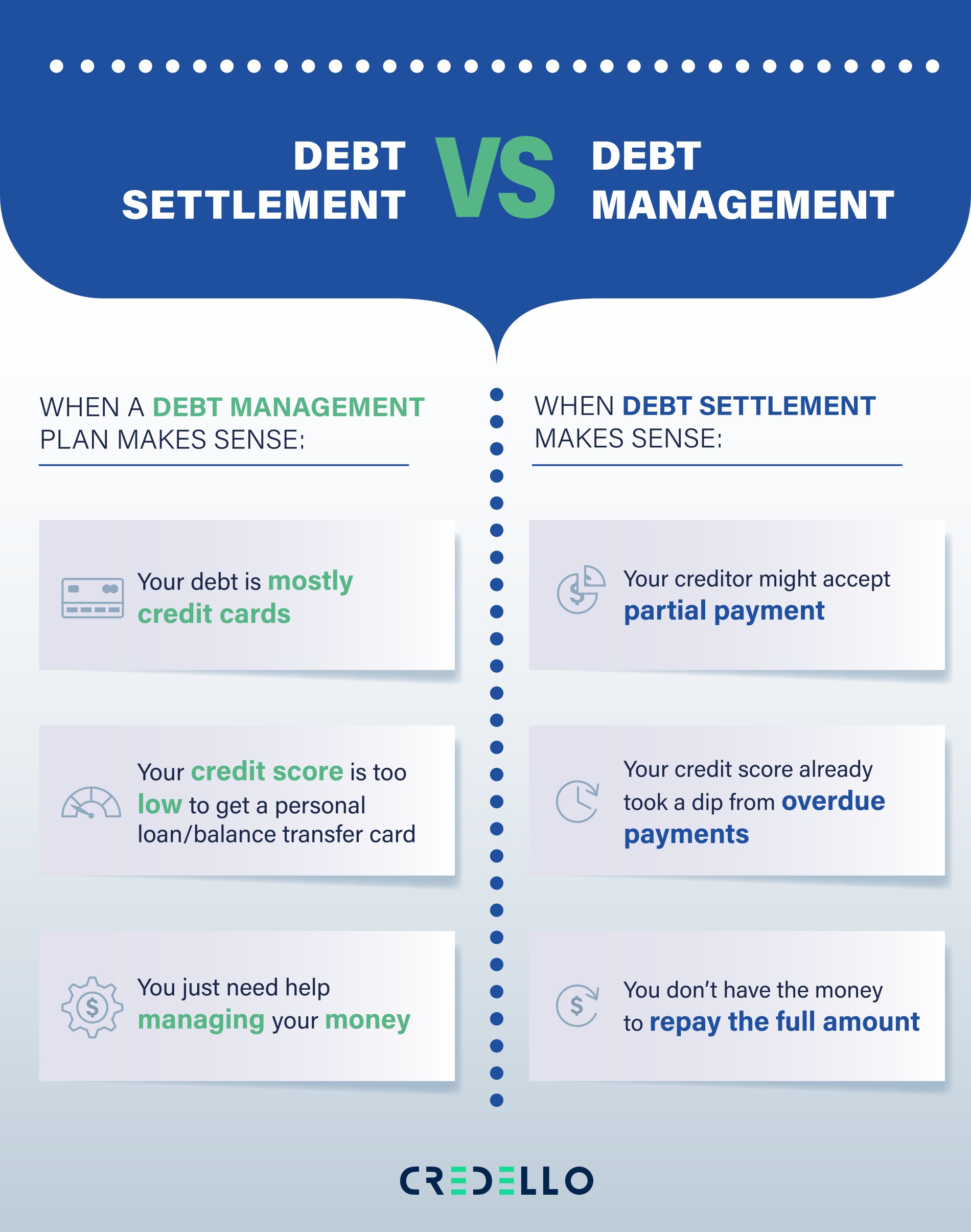

While numerous financial obligation relief techniques exist, choosing the appropriate one relies on individual financial conditions and objectives. Some of one of the most typical techniques consist of financial debt consolidation, financial debt monitoring visit this site plans, and debt negotiation.

Debt debt consolidation entails incorporating numerous debts right into a solitary loan with a reduced rates of interest. This strategy simplifies settlements and can minimize monthly obligations, making it less complicated for people to gain back control of their finances.

Debt management strategies (DMPs) are made by credit therapy firms. They work out with lenders to lower rate of interest and produce an organized payment plan. This option enables individuals to pay off debts over a fixed period while benefiting from specialist guidance.

Debt settlement entails discussing straight with financial institutions to resolve debts for less than the overall quantity owed. While this technique can offer immediate relief, it may affect credit history and usually includes a lump-sum repayment.

Lastly, bankruptcy is a legal choice that can provide remedy for overwhelming debts. However, it has long-lasting economic ramifications and should be considered as a last hope.

Picking the appropriate strategy requires careful examination of one's economic scenario, making sure a tailored method to accomplishing long-term security.

Actions Towards Financial Flexibility

Next, establish a practical budget that prioritizes basics and promotes financial savings. This spending plan should include provisions for financial obligation settlement, enabling you to allocate excess funds that site efficiently. Complying with a spending plan helps grow disciplined costs behaviors.

When a spending plan is in location, think about involving a financial obligation specialist. These professionals use tailored methods for handling and decreasing financial obligation, offering understandings that can quicken your trip towards economic liberty. They may recommend alternatives such as debt combination or settlement with lenders.

Furthermore, focus on constructing a reserve, which can prevent future financial strain and offer satisfaction. Finally, purchase economic literacy via workshops or resources, enabling educated decision-making. Together, these steps produce a structured technique to attaining monetary flexibility, transforming goals into truth. With commitment and notified activities, the prospect of a debt-free future is within reach.

Conclusion

Engaging financial debt consultant solutions supplies a strategic technique to attaining financial debt relief and economic flexibility. Inevitably, the proficiency of financial debt professionals significantly improves the chance of browsing the intricacies of financial debt management effectively, leading to a much more safe and secure financial future.

Engaging the services of a financial debt consultant can be an essential action in your journey in the direction of accomplishing financial debt alleviation and financial stability. Debt specialist services provide specialized advice for individuals grappling with economic obstacles. By assessing your earnings, debts, and expenditures, a debt expert can aid you recognize the origin triggers of your financial distress, enabling for a more exact technique to resolution.

Engaging financial obligation consultant solutions supplies a critical technique to accomplishing financial Visit This Link obligation alleviation and monetary flexibility. Ultimately, the knowledge of financial debt specialists significantly enhances the chance of navigating the intricacies of financial debt administration properly, leading to an extra safe and secure monetary future.

Report this page